Notice Regarding Commencement of Tender Offer for Ascot Corp.

Investor Relations

Jan. 31, 2025

Daito Trust Construction Co., Ltd. hereby announces that it has resolved at a meeting of its Board of Directors held on January 31, 2025, to acquire shares of Ascot Corp. (Securities code: 3264, listed on the Standard Market) through a tender offer under the Financial Instruments and Exchange Law.

1. Outline of the Tender Offer

・Daito will conduct a tender offer to acquire all common shares and stock acquisition rights of Ascot, excluding Ascot’s treasury stock, and make Ascot a wholly owned subsidiary of us.

・Sun Ye Company Limited. (44.96% stake), the parent company of Ascot, SBI Holdings, Inc. (32.17% stake), the second largest shareholder, and Ping An Japan Investment No. 1 Fund L.P. (5.65% stake) have also signed an agreement to tender their shares in the tender offer as of today.

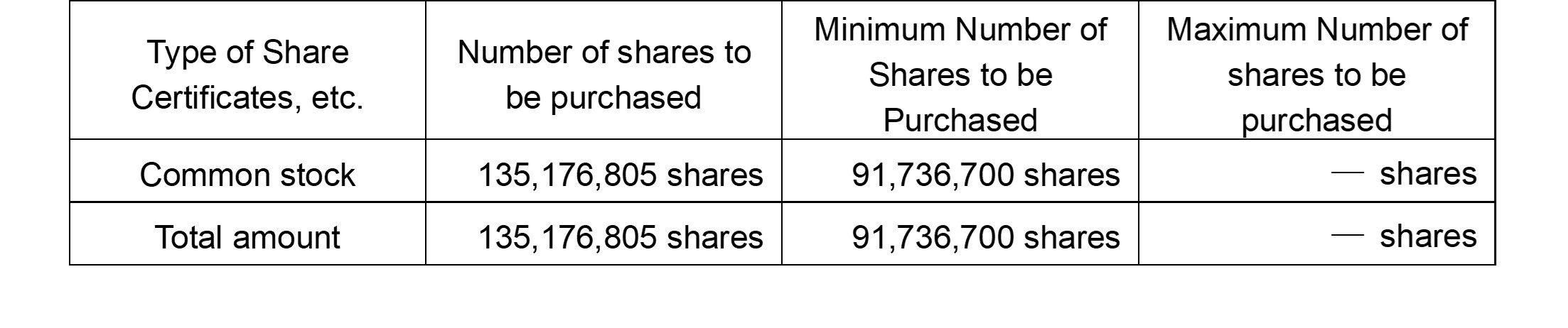

・Daito will not set a maximum number of shares to be purchased, as its goal is to make Ascot a wholly owned subsidiary.

・Sun Ye Company Limited. (44.96% stake), the parent company of Ascot, SBI Holdings, Inc. (32.17% stake), the second largest shareholder, and Ping An Japan Investment No. 1 Fund L.P. (5.65% stake) have also signed an agreement to tender their shares in the tender offer as of today.

・Daito will not set a maximum number of shares to be purchased, as its goal is to make Ascot a wholly owned subsidiary.

2. Purpose of the Acquisition

・Since its establishment in April 1999, and Ascot has built a strong brand as a real estate developer that leverages its planning and development capabilities to develop well-designed residences in central

Tokyo. The Company’s core businesses are rental condominium development, office development,

condominium development, and investment in income-producing real estate in Tokyo, as well as the

development of logistics facilities in the suburbs; management of joint investment funds with domestic

and foreign investors, and condominium development in the Kyushu area. The Company is steadily

progressing with its management plan and achieving good results.

・On the other hand, Ascot’s performance is easily affected by the uncertain business environment, including economic trends, interest rate trends, land price trends, real estate sales, and construction cost

trends. In addition, as of September 30, 2024, the Company did not meet the criteria for a tradable share ratio of 25% or more, which is the standard for maintaining a listing on the Standard Market. Given these management challenges, the Company has considered collaborating with other companies and utilizing external capital.

・Daito was also considering seeking a capital alliance partner to expand its real estate development business, one of its priority policies, as it promotes real estate development in central Tokyo, strengthens its purchasing power, and secures sales channels. In early May 2024, Daito recognized the high degree of business affinity between Daito and Ascot through their efforts toward building contracting and other transactions since late January 2024 and that further deepening the cooperative relationship between the two companies would contribute to the further expansion of their real estate development business.

・Daito’s real estate development business segment is expected to achieve the goal of 100 billion yen in real estate investment under the medium-term management plan, making it one of the pillars of the Daito Group by 2030. In addition, the two companies will maximize their corporate value by strengthening and expanding Ascot’s asset management and real estate leasing and administration business.

Tokyo. The Company’s core businesses are rental condominium development, office development,

condominium development, and investment in income-producing real estate in Tokyo, as well as the

development of logistics facilities in the suburbs; management of joint investment funds with domestic

and foreign investors, and condominium development in the Kyushu area. The Company is steadily

progressing with its management plan and achieving good results.

・On the other hand, Ascot’s performance is easily affected by the uncertain business environment, including economic trends, interest rate trends, land price trends, real estate sales, and construction cost

trends. In addition, as of September 30, 2024, the Company did not meet the criteria for a tradable share ratio of 25% or more, which is the standard for maintaining a listing on the Standard Market. Given these management challenges, the Company has considered collaborating with other companies and utilizing external capital.

・Daito was also considering seeking a capital alliance partner to expand its real estate development business, one of its priority policies, as it promotes real estate development in central Tokyo, strengthens its purchasing power, and secures sales channels. In early May 2024, Daito recognized the high degree of business affinity between Daito and Ascot through their efforts toward building contracting and other transactions since late January 2024 and that further deepening the cooperative relationship between the two companies would contribute to the further expansion of their real estate development business.

・Daito’s real estate development business segment is expected to achieve the goal of 100 billion yen in real estate investment under the medium-term management plan, making it one of the pillars of the Daito Group by 2030. In addition, the two companies will maximize their corporate value by strengthening and expanding Ascot’s asset management and real estate leasing and administration business.

3. Synergies between the two companies in the real estate development area

・Strengthen and expand real estate development business: Ascot develops and renovates condominiums and offices mainly in the central 23 wards of Tokyo and the Kyushu area, while Daito Group’s development areas are primarily in the outer fringes of the central Tokyo area. Since there is no competition between the two companies’ development areas, sharing real estate information can expand both companies’ development areas.

・Strengthening and expanding the asset management business of the Ascot Group: Daito Group’s development projects will be supplied to funds managed by Ascot, thereby increasing the assets under management.

・Real estate leasing and management business collaboration: The Daito Group has a track record of managing approximately 1.3 million units nationwide, and sharing its know-how in rental management will contribute to the development and growth of the Ascot Group’s rental management business.

・Diverse growth of employees and strengthening of organizational structure: Through utilizing the training systems of both groups and exchanging human resources, the two companies aim to achieve the diverse growth of employees on both sides and strengthen the organizational structure.

・Strengthening and expanding the asset management business of the Ascot Group: Daito Group’s development projects will be supplied to funds managed by Ascot, thereby increasing the assets under management.

・Real estate leasing and management business collaboration: The Daito Group has a track record of managing approximately 1.3 million units nationwide, and sharing its know-how in rental management will contribute to the development and growth of the Ascot Group’s rental management business.

・Diverse growth of employees and strengthening of organizational structure: Through utilizing the training systems of both groups and exchanging human resources, the two companies aim to achieve the diverse growth of employees on both sides and strengthen the organizational structure.

4) Ascot’s expected synergy effects

Ascot expects that the strengthening of the alliance between the two companies will (1) strengthen its financial position (increase the scale of borrowings and reduce fund-raising costs), (2) further expand its real estate fund business, (3) further expansion of the logistics development business, and (4) reasonable cost reductions in contracted construction work.

5. Outline of the Tender Offer

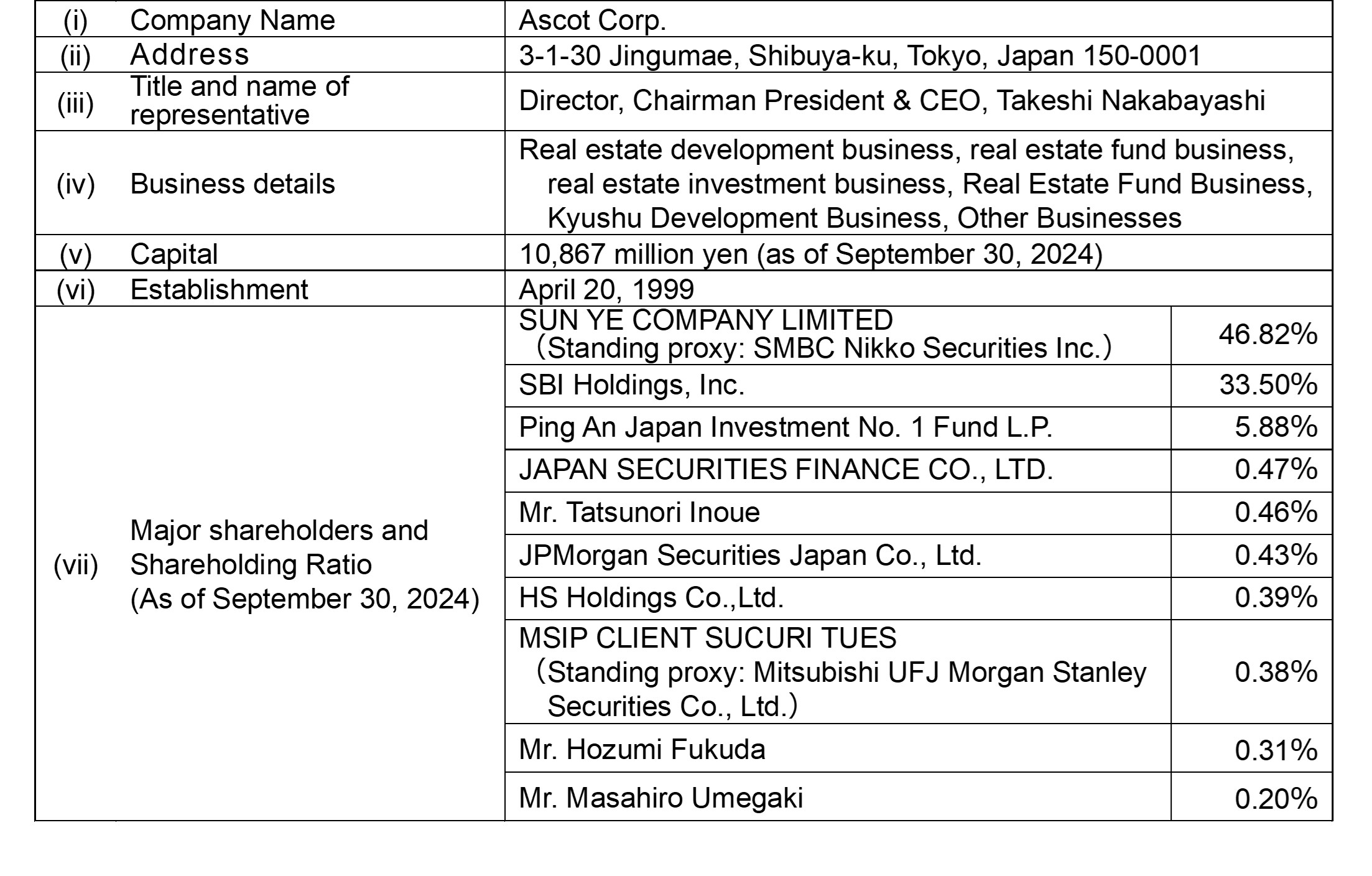

(1) Outline of Ascot (As of Sep.30.2024)

(2) Class of shares to be purchased

(i) Common stock

(ii) Stock Acquisition Rights

The 7th series of stock acquisition rights was issued upon resolution of the Target Company's general meeting of shareholders held on December 16, 2020 (exercise period is from February 1, 2021, to January 31, 2026)

(i) Common stock

(ii) Stock Acquisition Rights

The 7th series of stock acquisition rights was issued upon resolution of the Target Company's general meeting of shareholders held on December 16, 2020 (exercise period is from February 1, 2021, to January 31, 2026)

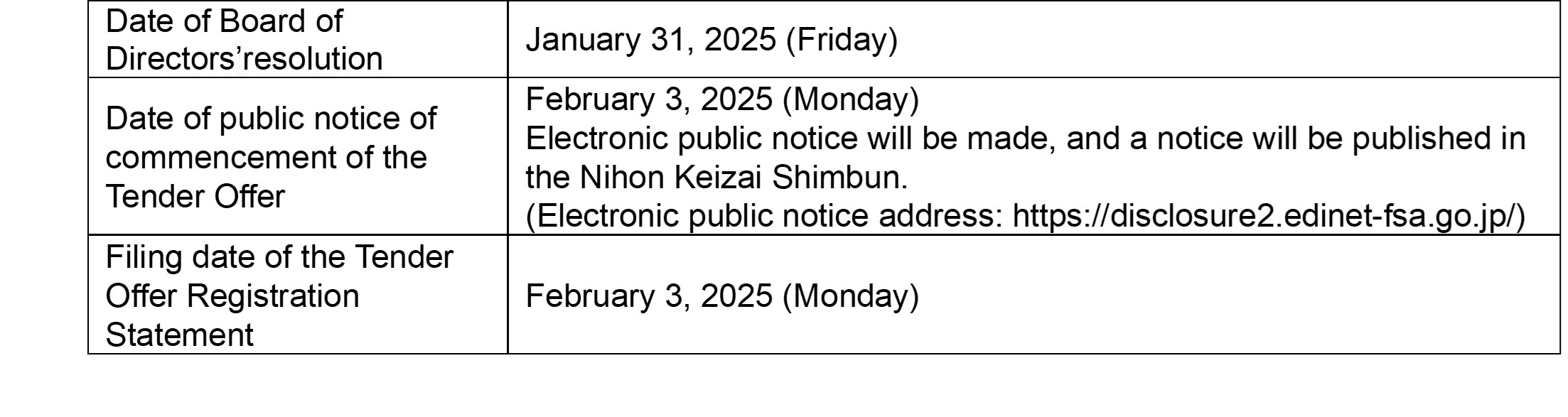

(3) Schedule

Initial Tender Offer Period

From Monday February 3, 2025, to Tuesday March 18, 2025 (30 business days)

Initial Tender Offer Period

From Monday February 3, 2025, to Tuesday March 18, 2025 (30 business days)

(4) Tender offer price

(i) Yen per share of common stock

(ii) Yen per one (i) Stock Acquisition Right

(i) Yen per share of common stock

(ii) Yen per one (i) Stock Acquisition Right

(5) Number of Share Certificates to be Purchased

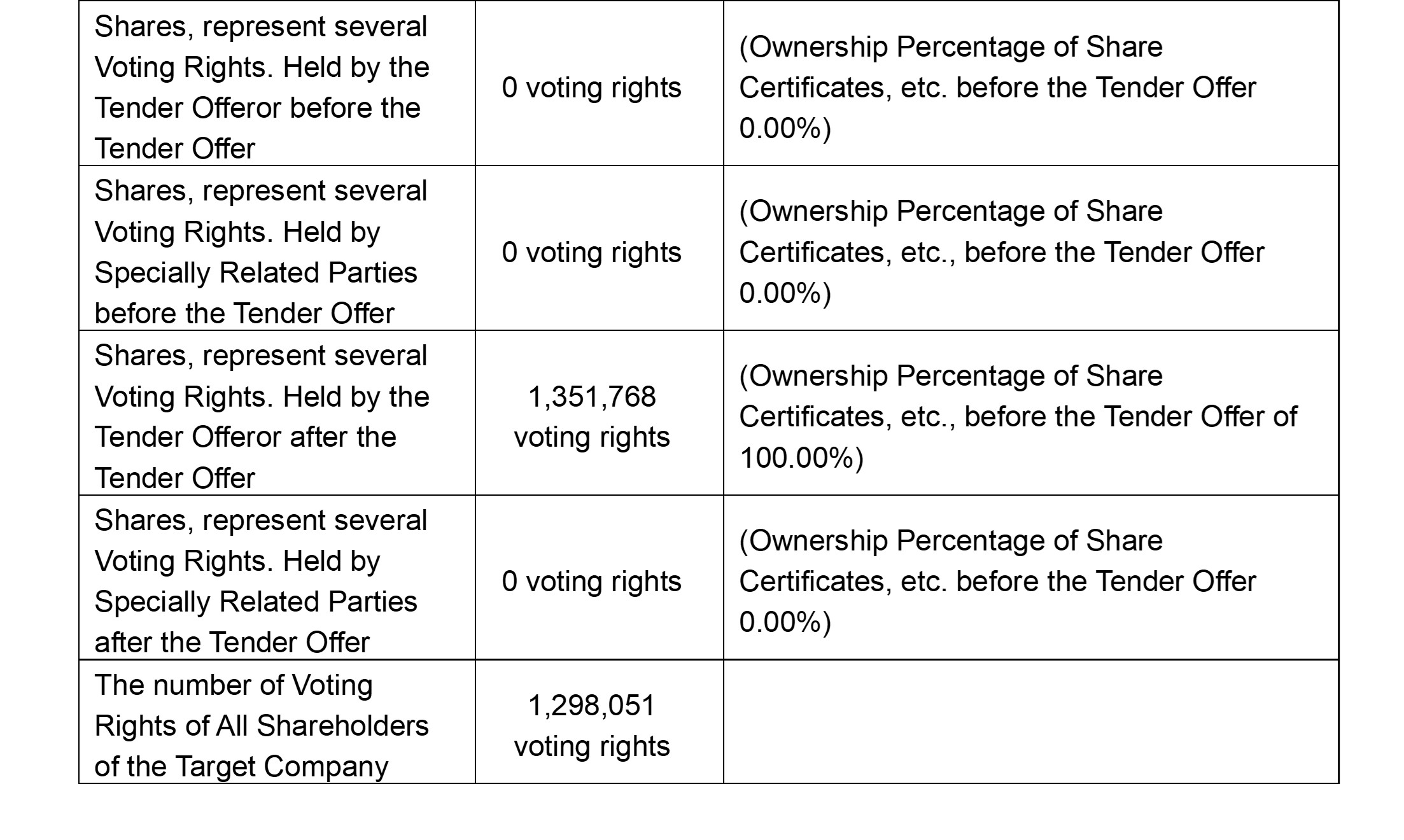

(6) Change in the Percentage of Ownership of Share Certificates, etc., as a result of the Tender Offer

(7) Purchase Price 35,145 million yen

(Note) The “Purchase Price” is the amount obtained by multiplying the number of shares to be purchased in the Tender Offer (135,176,805 shares) by the Tender Offer Price (260 yen).

(8) Method of Settlement

(i) Name and Location of Head Office of Securities Companies and Banks, etc., in Charge of Settlement

Mizuho Securities Co.

(ii) Commencement date of settlement

March 26, 2025 (Wednesday)

(Note) The “Purchase Price” is the amount obtained by multiplying the number of shares to be purchased in the Tender Offer (135,176,805 shares) by the Tender Offer Price (260 yen).

(8) Method of Settlement

(i) Name and Location of Head Office of Securities Companies and Banks, etc., in Charge of Settlement

Mizuho Securities Co.

(ii) Commencement date of settlement

March 26, 2025 (Wednesday)

Contact:

Public Relations Section, Public Relations Department, Daito Trust Construction Co., Ltd.

2-16-1 Konan, Minato-ku, Tokyo 108-8211, Japan

Tel. +81-3-6718-9174 / Email koho@kentaku.co.jp / Website https://www.kentaku.co.jp/

- About Us

- Investor Relations