If you would like to see and print PDF file, you need install Adobe Reader(free).

Outline of Corporate Governance

Unique Features of the Daito Group’s Governance System

Corporate Governance Basic Policy

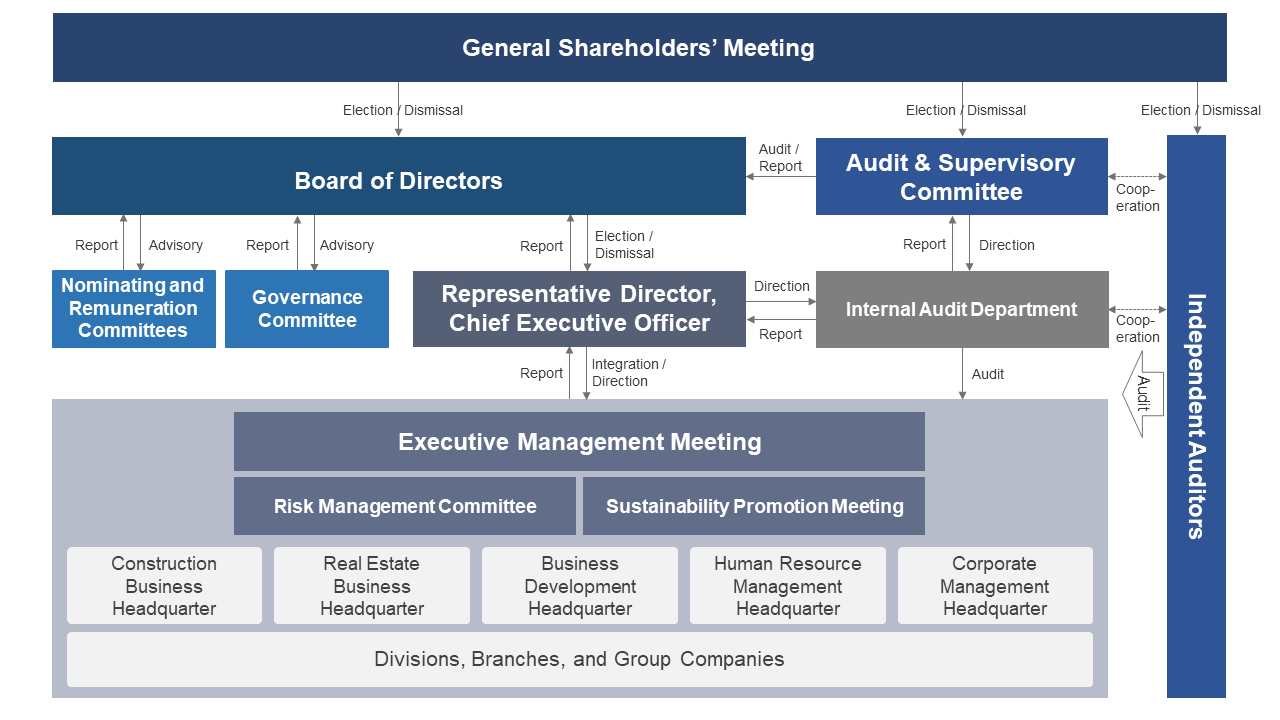

The Company’s basic policy is to maximize corporate value for shareholders and all other stakeholders and to improve the transparency and efficiency of management. To this end, the Company defines the roles of management supervision and business execution to establish a prompt and efficient system for implementing management and business decisions. Through the participation of Outside Directors, it also seeks to achieve highly transparent management.

Management Structure

The Company has adapted a company with an audit & supervisory committee since June 2023, to clarify responsibilities for managerial decision-making, supervision and business execution, leading to stronger supervision and speedy decision-making.

The Board of Directors decides on matters stipulated in laws and regulations and the Articles of Incorporation and other important matters involving the Company and Group companies.The Company delegates, as necessary, decision-making authority for business execution from the Board of Directors to Executive Officers to enable flexible decision-making.

The Company has divided the business areas of the Company and Group companies into “Headquarters in charge of Construction Business,” “Headquarters in charge of Real Estate Business,” “Headquarters in charge of Business Development,” “Headquarters in charge of Human Resource Management” and “Headquarters in charge of Corporate Management,” and assigns Directors as the General Manager responsible for each headquarters.

Audit & Supervisory Committee

Established on June 27, 2023, the Audit & Supervisory Committee comprises four members, three of whom are independent outside directors. Two become standing members. The committee monitors, supervises, and audits the legality and appropriateness of directors’ execution of business based on Audit & Supervisory Committee regulations and the relevant in-house regulations.

Nominating and Remuneration Committee

The Company has established a Nominating and Remuneration Committee (chaired by the Lead Independent Outside Director) to study matters such as mutual evaluations of Directors and the composition of the board for the subsequent year. The Nominating and Remuneration Committee is composed of Representative Director and all Outside Directors who are not Audit & Supervisory Committee Members. Efforts are taken to curb autocratic decisions by the management team, including Representative Directors, and to strengthen governance functions by having the Nominating and Remuneration Committee participate in evaluations of Directors, examinations of the management structure for the next year, and performance-linked remuneration for Directors.

Governance Committee

The Company has established a Governance Committee (chaired by the Lead Independent Outside Director) composed of three internal Directors, including Representative Director, and all Outside Directors. Efforts are made to strengthen supervisory functions with the Governance Committee, with a focus on deliberations concerning corporate governance.

- About Us

- Investor Relations